Oschadbank has introduced a new application named Samo, combining banking functions with a shopping platform. This service is designed for small and medium-sized businesses, particularly those lacking their own online stores, as reported by Forbes. Users can select a partner, place an order, pay through the app, and pick up their items in-store.

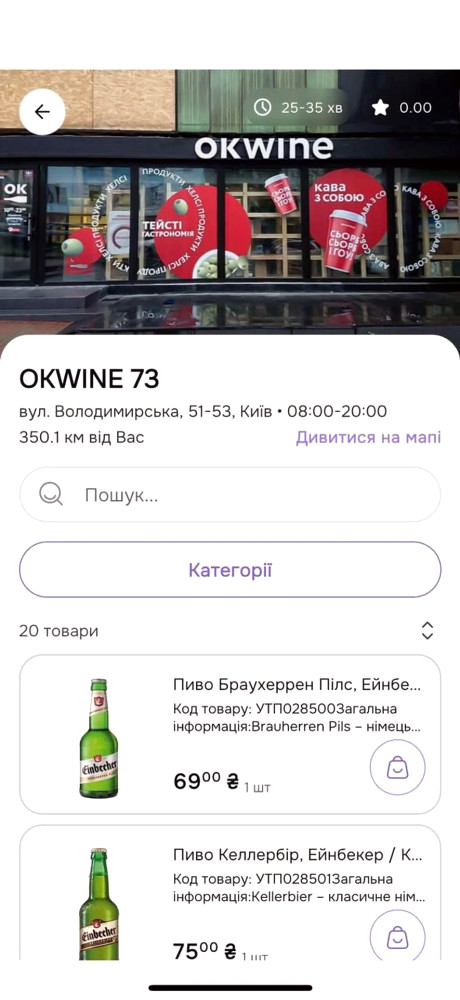

Samo has already partnered with several major companies such as WOG, Socar, Winetime, and Okwine, along with various local businesses in Kyiv, Dnipro, Kropyvnytskyi, and Chernihiv. There are plans to expand features, including Shop&Go, which will enable users to scan products in stores and pay online, avoiding queues.

Anton Tyutyun, Deputy Chairman of Oschadbank, stated that the idea for Samo emerged at the beginning of the pandemic, but the project was only realized in 2023. While the development costs remain undisclosed, experts estimate them to be between $100,000 and $360,000.

Despite the official launch, users faced issues: SMS codes for login were not received, bank card linking was problematic, and some product categories were empty. A Forbes journalist was unable to access the application for several days.

"This is not even a beta; it’s a false start," commented Artem Shevchenko, CEO of market by mono, adding that the app operates inconsistently and that curbside pickup is only available with significant delays.

Oschadbank acknowledges that Samo is still imperfect but considers it an important step in expanding the bank's ecosystem. There are plans to scale Samo to other cities and actively onboard new partners by 2025.

According to bank representatives, Samo aims to complement Oschadbank's digital service portfolio, including traditional online banking and the “My ЖК” app for homeowners' associations. Experts believe that while the service may not compete directly with Glovo or Rozetka, it could serve as an effective tool to support small businesses and retain bank customers.