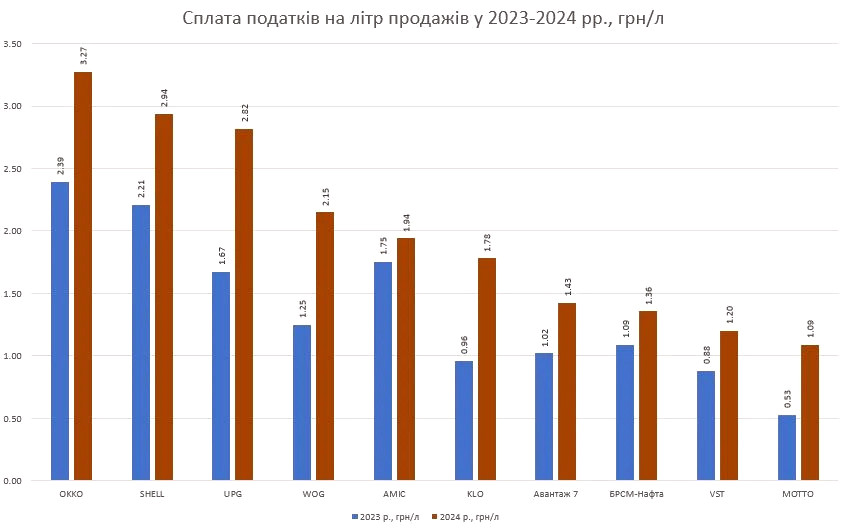

The total amount of tax payments made by the top 10 gas station networks, which account for 54% of fuel sales in the country, more than doubled in 2024.

This is reported by the specialized publication enkorr, citing data from the director of the consulting group "A-95", Serhiy Kuyn.

"In 2024, the total tax payments increased from 4.7 to 9.8 billion UAH, an increase of 5.1 billion UAH, despite a 2.9% decrease in sales," he wrote.

The expert explained that the taxes include VAT (excluding import VAT), profit tax, personal income tax, and social security contributions.

In particular, according to a study conducted by "A-95", VAT payments tripled from 1.4 to 4.2 billion UAH. This is partly explained by the end of the preferential 7% rate in the first half of 2023. Meanwhile, the dynamics of growth among the networks are extremely uneven: from 8.92% in "BRSM" to 2.5 times in UPG and 3 times in KLO.

"Profit tax increased by 1.5 times to 2.2 billion UAH. Again, growth ranged from 13% in OKKO to 2 times in WOG and UPG, and 7.5 times in Motto. KLO and Avantage 7 showed a decrease in profit," noted the head of "A-95".

Payroll taxes — personal income tax and social security contributions — rose by 85%, or 1.6 billion UAH, to 3.4 billion UAH. Meanwhile, the average official salary in the top 50 increased over the year from 11,853 to 17,482 UAH/month. The most significant increase in official salaries was recorded in Avantage 7 and "BRSM".

According to Serhiy Kuyn, the increase in tax payments occurred mainly due to pressure from the tax service, lawmakers, and the expert community.

"However, there remains a significant gap between the leaders and laggards among taxpayers in the fuel market, indicating, firstly, potential budget losses in 2024 and, secondly, the potential for increased budget revenues this year," he emphasized.

Reminder:

In February 2025, retail prices for gasoline, diesel, and autogas at Ukrainian gas stations did not significantly decrease .